Are you interested in KONE as a corporate business or a career opportunity?

Corporate siteWide global exposure and strong position in the key growth markets

The global scale of the business provides stability: KONE is present in the Europe, Middle East and Africa area (41% of sales in 2019), Asia-Pacific (39%) and North America (21%).

KONE is one of the leading companies in the industry and has a strong market position especially in the growing Asian markets.

| EMEA

| North America

| China

| Rest of Asia-Pacific

| |

|---|---|---|---|---|

| New equipment

| #2

| #4

| #1

| #1

|

| Maintenance

| #3

| #4

| #1

| #2 |

A life-cycle business with high amount of stable service revenue

KONE’s business model is to provide solutions for the full lifecycle of equipment, starting from the sale of new equipment, through maintenance and modernization.

Strong megatrends supporting new equipment market growth, which feeds into growth of equipment in maintenance. The installed base of elevators and escalators is aging, providing a growing need of equipment modernization.

Driving competitiveness through innovation and productivity

We retain our challenger attitude and develop our competitiveness by continuously looking for new ways to add value for our customers with our services and solutions. We also systematically strive to improve productivity and quality.

We are proud of our innovation track record. With over 3,000 patents across our businesses, we consider ourselves the innovation leader in our industry and with our partners, we constantly strengthen this position. KONE’s innovative solutions include breakthrough technologies such as the machine-room-less elevator and a superlight hoisting rope that enables elevator travel of up to 1 kilometer.

With constant development of competitiveness, KONE has grown faster than the market.

Capital-light and cash-generative business model

Low amount of fixed assets required

KONE’s business is capital-light. We have manufacturing units in all the key regions. However, we also cooperate with many component suppliers. As a result, the level of tangible and intangible assets is relatively low in the business

Strong cash generation and good dividend yield

We receive advance and progress payments from our customers across businesses and geographies. This enables us to have negative net working capital and strong cash generation.

The cash generative business model has enabled steadily developing dividends for shareholders.

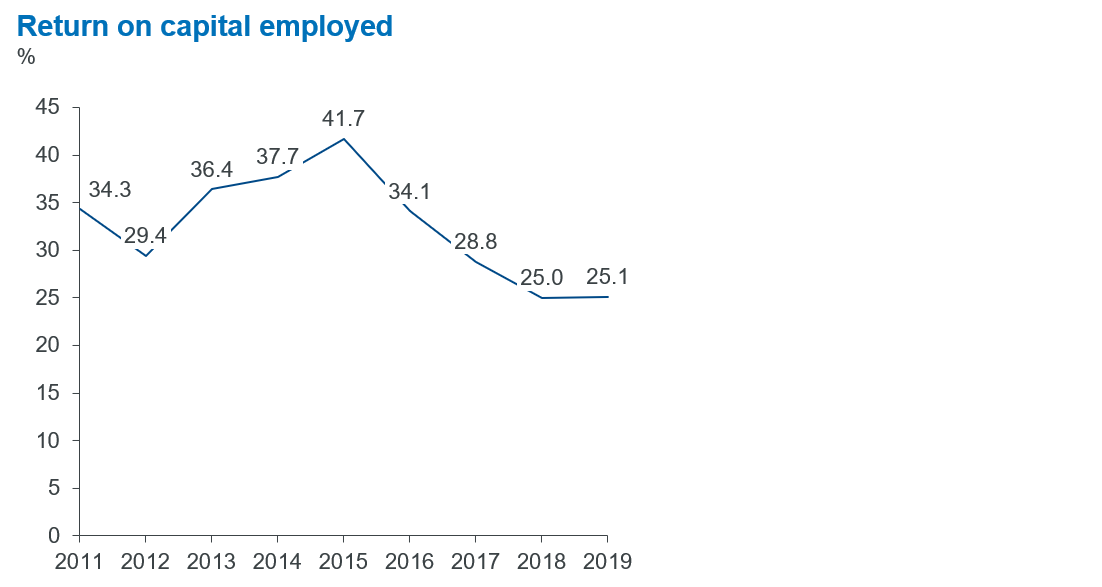

High return on capital employed

Good profitability combined with our capital light business model enables high return on capital.

Calculation of return on capital employed = [(net income + financing expenses) / (equity + Interest-bearing-debt (average of the figures for the accounting period))] x 100